What are the top reasons why you should start investing? This is a natural question to ask of a Level Zero investor. Personally, it was my first question (see the first blog post.) When brainstorming how to write this article, I thought I could narrow it down to “The Best” or “The Only Reason” to start investing, but I realized there was more than one reason. As I wrote them down, I saw overlap among each other. Ultimately it is up to you to find that reason because it will influence the path you take. Keep reading below to find the Top 5 reasons to start investing.

Key Takeaways

- Top 5 Reasons to invest include:

- Fighting inflation

- Getting to retirement sooner

- Building wealth

- Gaining financial freedom

- Putting your money to work

- One or more of these reasons should help inspire Level Zero investors to begin investing.

Reason #1: Inflation

The first reason why you should start investing is based on Inflation. More specifically, on how to “fight inflation”.

This is relevant today due to the global economic situation; the May 2022 US inflation rate is at 8.6%, reported as here by the U.S. Department of Labor. A fantastic report that we can deep dive into another day. But we will ignore the current rate for now and focus on historical inflation numbers, which are roughly 2%-3% each year. So why should you start investing to fight inflation? Before I answer that, a Level Zero investor needs to know what “inflation” means.

There are two different ways to understand inflation.

- The rate at which the prices of goods and services increase over time.

- The decrease in purchasing power.

Inflation Example 1

If the cost of a 24-pack of Diet Mountain Dew (my favorite pop) used to cost $10 last year, but due to 3% inflation, it now costs $10.30. This percentage can vary from product to product (as seen in the U.S. Department of Labor report) so it is usually calculated/reported as an average.

Inflation Example 2

To explain purchasing power, I like to use the example of those who hide their savings under their mattress. Say they keep $100 stored away, thinking it’s safer there because it won’t lose or decrease value by buying stocks. However, if one year later this individual wants to use that $100 to buy a new winter jacket, but due to inflation at 3%, that jacket now costs $103. We see that the $100 does not retain its value as it once did, hence a loss in purchasing power.

So why should you invest? To fight inflation. To keep the value of the money you are saving for the future. Inflation is inevitable; the cost of goods and services will continue to rise over time. As a Level Zero investor, you must do your best to get ahead of inflation.

Reason #2: Retirement

We all want to retire sooner rather than later. We want to enjoy as much of life while we’re young and healthy. Investing can help you reach that milestone sooner than expected. Why wait till 65 to retire, when you can retire at 60, 50, or even in your 30s?

Before you think, “I already have a retirement plan with my 401k or another retirement plan through my employer, I shouldn’t need to invest more”, you’re wrong. I’m not saying DON’T use those employee benefits, especially if they do any matching, I’m saying there are other benefits, such as: retiring sooner and extra tax benefits.

Investing Will Reach Your “Number” Faster

There’s a general rule of thumb called the 4% rule, The Motley Fool has a good article about it here, that helps you determine the amount you need to save to retire.

First, find your monthly expenses; if you expect your expenses to be around $4,000 per month, multiply this by 12 to get an annual number and divide by four percent: $4,000 * 12 / (0.04) = $1,200,000. That’s the amount you need to save to retire by the age of 65 and if you are currently 35 years old, you have 30 more years of investing. Regardless of your 401k or another retirement plan, if you were to contribute $6,000 per year into a Roth IRA for 5 years with an expected 10% return (average annual S&P500 return), and let that money sit and gain money/interest until you’re 65, the total amount would come to almost $400,000. You only contributed a total of $30,000, but investing it got you 33% of the way to your retirement goal ($400k / $1.2M).

Extreme Strategy: F.I.R.E.

The 4% rule is a good goal for those who plan on retiring at 65, but there are extreme investment strategies out there, such as F.I.R.E; Financial Independence, Retire Early. These investors live as minimally as possible in the hope of retiring within a 5-year window. Here is a quick article for those interested in learning more now. This is an advanced topic we can talk about later, but where there’s a will there’s a way, and people are getting it done.

Retirement is looking much different now than it did just a couple of decades ago as strategies have evolved. The biggest takeaway though is that by investing early, you can reach your retirement goals even sooner.

Reason #3: Build Wealth

Rather than focusing on Retirement, like in Reason #2, some might invest to build their wealth. I have two ways of defining wealth, a simple and technical answer.

- Simple: having a surplus of money

- Technical: having more Assets than Liabilities

We won’t go over Assets and Liabilities right now, a future topic, but these two definitions mean the same thing. The goal of building wealth is when your income (money going into your pocket) is greater than your expenses (money leaving your pocket.) As your pockets get “heavier” you start to accumulate wealth. At that point you have options of what to do with your “wealth”, the best option would be to re-invest it into more Assets that will continue to put more money into your pockets. That is how true wealth is created.

Reason #4: Financial Freedom

When I started learning about investing, many YouTube videos, books, blogs, articles, etc. discussed how investing could help you achieve “Financial Freedom”, but I didn’t understand what that meant. Was it simply, building wealth and retiring early? Maybe yes, maybe no? Maybe it means the freedom to get out of the “Rat Race”. To feel like you’re not always spinning your wheels, living paycheck to paycheck, to make other people money. Maybe it’s the ability to be your own boss. Start your own business. Perhaps it’s being able to live debt-free.

Financial Freedom can mean lots of things to lots of people. You may not have the answer to this question right now, but I can tell you that if you start investing, you will be able to see how it can change your life and get you to whatever goal you desire.

Reason #5: Putting Your Money to Work for You

Putting your money to work is the most exciting reason to want to start investing. I know this is #5 on the list, but maybe I should have put this as the #1 reason why you should start investing.

I’ve only just started my investing journey, so the little amount of money that I have within individual stocks is not much, I’ve only found a few good companies/stocks that I’ve bought into. However, I’ve invested in some companies that pay Dividends, (companies will pay me money based on how much I’ve invested in them), and on these alone, if I invested nothing else for the rest of the year, I could get an estimated $20 in payments. It doesn’t seem like a lot, not now, but it excites me to think about how a company will pay me for just being a part of that company. Plus, I plan on taking those dividends and reinvesting them back into those companies. Just like Building Wealth, I am putting my money to work to make more money and turning around to get more Assets/stocks to get me even more money.

The Rich vs. The Poor

Do you know the biggest difference between the Rich and the Poor? Rich people take their money and re-invest it into more investments or Assets that will continue to make them even more money, whereas the Poor spend their money on “things” or Liabilities. Again, the big difference of money going into your pocket versus out of your pocket.

The first book I read on investing was “Rich Dad, Poor Dad” by Robert Kiyosaki. I believe all Level Zero investors should start by reading this book. Robert explains in the book, that as a kid he had two dads, his Rich Dad and a Poor Dad. His Poor Dad was his biological father, who taught him to get a good education and find a job where he would work until you retired. His Rich Dad didn’t have a fancy education and a life-long career, but his Rich Dad understood how to make money work for him; he had different types of investments, owned businesses, and employed others to help run his businesses and others. The two Dads managed their money differently. He describes some of the topics I mentioned earlier, such as Balance Sheets with Assets and Liabilities, talks about Cash Flow, and other useful investing topics. A great read to get started and introduced to why you should think about money differently. You can get a copy of the book here.

Compounding – A HUGE Reason Why You Should Start Investing

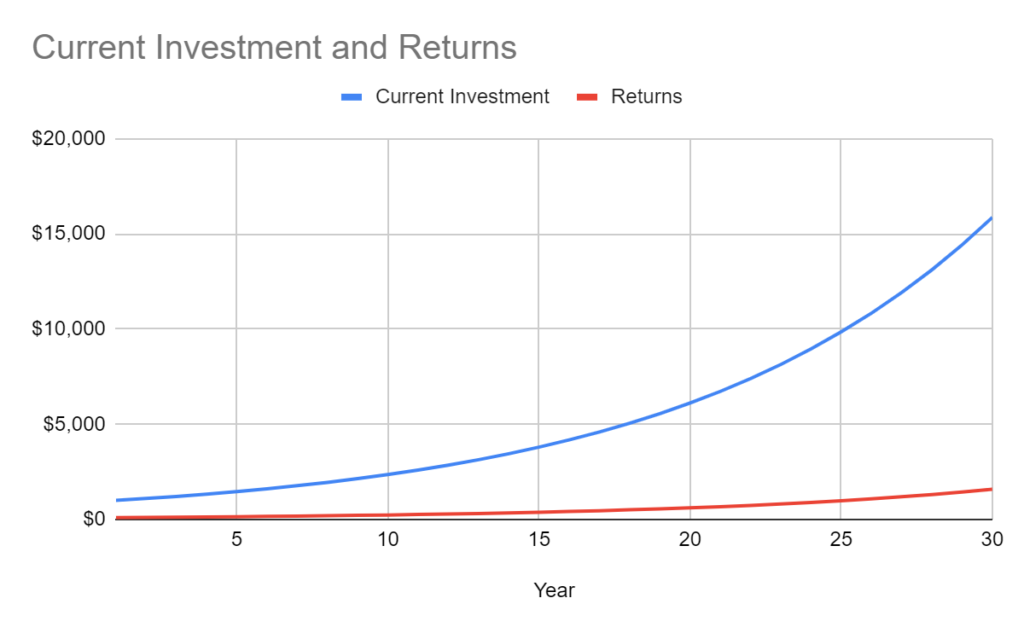

A good way of understanding putting your money to work for you is to understand how compounding works. Compounding tells you how over time, re-investing your returns year over year will have a snowball effect that shows greater and greater returns the more time you allow that snowball to roll downhill.

Another hypothetical example: you invest $1,000 into an investment that gives you a 10% return each year. After that first year, you will earn $100; $1,000 * 10% = $100. Now you can do whatever you want with that $100, spend it on goods and services OR you can re-invest it back into that $1,000. Compounding would tell you to put it back into the investment and now you have $1,100. Investors are in it for the long haul. Another year later, you gain another 10% return on $1,100 which will earn you $110, $10 more than the previous year. Not much more, but wait, it gets better. The table to the right shows the first 5 years of compounding and every 5 years afterward. What you’ll notice is that while small after first, the Returns at the 20-25-30-year mark are noticeably larger. At the 25-year mark, the return alone is more than the initial investment. This is truly where compounding plays into effect. For those who are visual people like me out there, below is a graph that shows this wonder. Compounding is NOT linear. That blue line over time starts to show an exponential curve, each year’s Return greater than the last, gaining on your gains. By doing nothing but re-investing, that $1,000 turned into almost $16,000. Compounding gave you $15,000 more than what you started with, versus if you would’ve cashed out the $100 each year, you would’ve only kept $3,000 (30 Years * $100); a 400% difference!

| Year | Current Investment | Returns |

| 1 | $1,000 | $100 |

| 2 | $1,100 | $110 |

| 3 | $1,210 | $121 |

| 4 | $1,331 | $133 |

| 5 | $1,464 | $146 |

| 10 | $2,358 | $236 |

| 15 | $3,797 | $380 |

| 20 | $6,116 | $612 |

| 25 | $9,850 | $985 |

| 30 | $15,863 | $1,586 |

You can do your own compounding interest calculations here.

with only a $1,000 Initial Investment and No Additional Contributions

“Compound interest is the 8th wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

Albert Einstein

Why Did I Choose to Start Investing?

At 36 years old, married with 3 kids, why did I choose to start investing? Everyone’s answer is different, and it might take time to come to your answer but knowing what is most important to me is my family; They are the reason why I wanted to start investing. The past two years of the COVID pandemic had one blessing in disguise, while working from home I got to see more of my kids growing up. My youngest, Ella, will turn 3 in August and if I were in the office rather than the basement of my house, I wouldn’t get to see her nearly as much. But in the future, I want to continue to be able to spend all the time I can with my family; attend my son’s sporting events, Ella’s dance recitals, and even the distant future, my grandchildren.

I took that leap. I started at Level Zero. I’ve learned. I’ve made mistakes. I’ve read books, and blogs, watched videos, and listened to podcasts. I’ve started my research. And I’ve found my reason. Find your reason and walk with me as a Level Zero investor.

What’s next? Learn More About Compounding!

I mentioned about how you should be putting your money to work for you. How once you do that, compounding will be an amazing force in your investment journey.

But what is Compounding? How does it work?

Read my Compounding for Beginners post to help you start building that wealth snowball!

Thanks for reading! Feel free to comment if you think I missed any reasons why you should start investing. I’d also love to hear the reason why you started investing. You can contact me here with any comments or questions.

Disclaimer

Levelzeroinvestor.com is not a registered investment, legal or tax advisor or a broker/dealer. All investments / financial opinions expressed by Levelzeroinvestor.com are from the personal research and experience of the owner of the site and are intended as educational material. Although best efforts are made to ensure that all information is accurate and up to date, occasionally unintended errors and misprints may occur.

magtnificent submit, very informative. I ponder whhy thhe opposite speciaslists of thjs

sectolr do not notice this. Youu must continue your writing.

I’m confident, you’ve a hge readers’ base already!

https://babu88-in.com/registration/

Вместо того чтобы критиковать посоветуйте решение проблемы.

Instead of criticism write the variants is better.

3592xc